The final report of the UK’s Independent Water Commission, led by Sir Jon Cunliffe, may not be in time to save Thames Water from a messy temporarily renationalization. The water company is going to decide in a month whether to appeal its current regulatory program to the Competition and Markets Authority (CMA), based on negotiations with Ofwat, the water industry’s soon-to-be-replaced regulator. If it does appeal, the company’s fate may remain uncertain while that appeal is pending.

Still, the Cunliffe Report is an important milestone with implications well beyond the UK and its privatized water industry. It is a comprehensive review of the causes of the crisis brewing in the UK’s water industry, and it addresses many questions relevant to public-private partnerships and the regulation of infrastructure projects in the United States and globally. This newsletter published a review of the report when it was published earlier this summer, but the Commission investigated too many topics to cover in any detail.

One of those topical deep dives was on a subject that has roiled the public discourse over the UK water industry over the last fifteen years: dividends. Do investor dividends reduce the financial resilience of the water companies? Or their environmental performance? How should they be monitored? Or regulated?

It was inevitable that the Cunliffe Report would address water company dividends and whether or how to regulate them. Investor dividends are addressed in nearly every news article or polemic written about the UK water industry. Nationalization advocates are obviously keen on the topic. Last year, a campaign group called “We Own It” estimated that 11% of industry revenue was spent on dividends, with one campaigner arguing that “[u]nder investment in sewage treatment has led to spills, while funds are directed to shareholders’ pockets instead.”

Ofwat now publishes a database of all water company dividends since the start of privatization. Last year, a paper out of the University of Greenwich tallied things up and concluded that with dividends, water company shareholders had withdrawn “a real net total of £85.2bn…“ from the water industry since privatization.

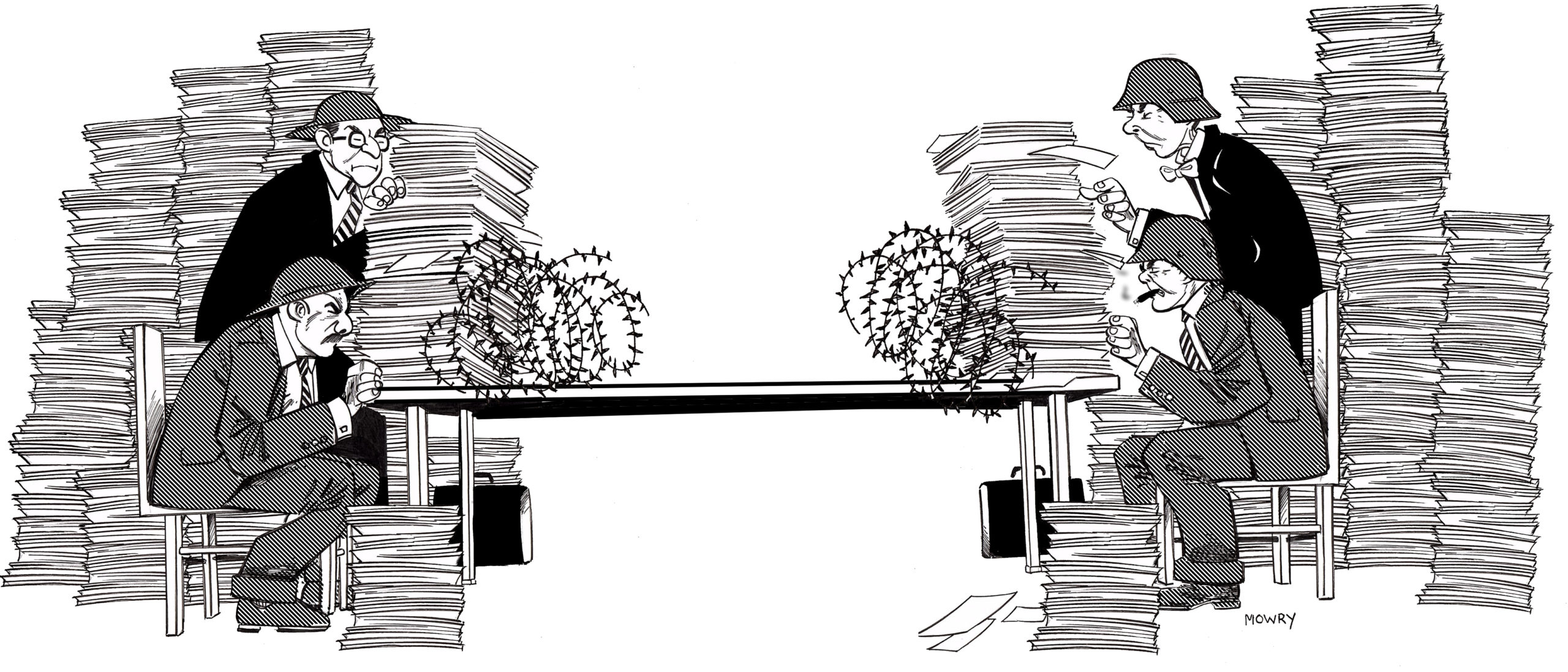

For years, Ofwat has required the water companies to not only report their dividends but to “explain how dividend payments take account of performance in delivering obligations and commitments to customers.” Beginning with its 2020-21 Monitoring Financial Resilience report, it has actually evaluated whether those justifications are clear enough, concluding that “[i]t is extremely disappointing that few companies met our expectations.”

Press and public scrutiny over dividends resulted in regulations beyond just reporting and justification as well. In 2021 a law was passed that gave Ofwat the power to unilaterally make adjustments to the water company licenses, and it then immediately set about modifying the licenses to regulate dividends. The change was completed in 2023, and required that company dividends not only not impair a company’s financial resilience, but “…take account of service delivery for customers and the environment…”

In other words, Ofwat essentially regulates the dividends of the water industry, and it has already enforced its new powers. In May, Ofwat fined Thames Water £18.2 million for paying two dividends that were not sufficiently “justified” per the new license conditions.

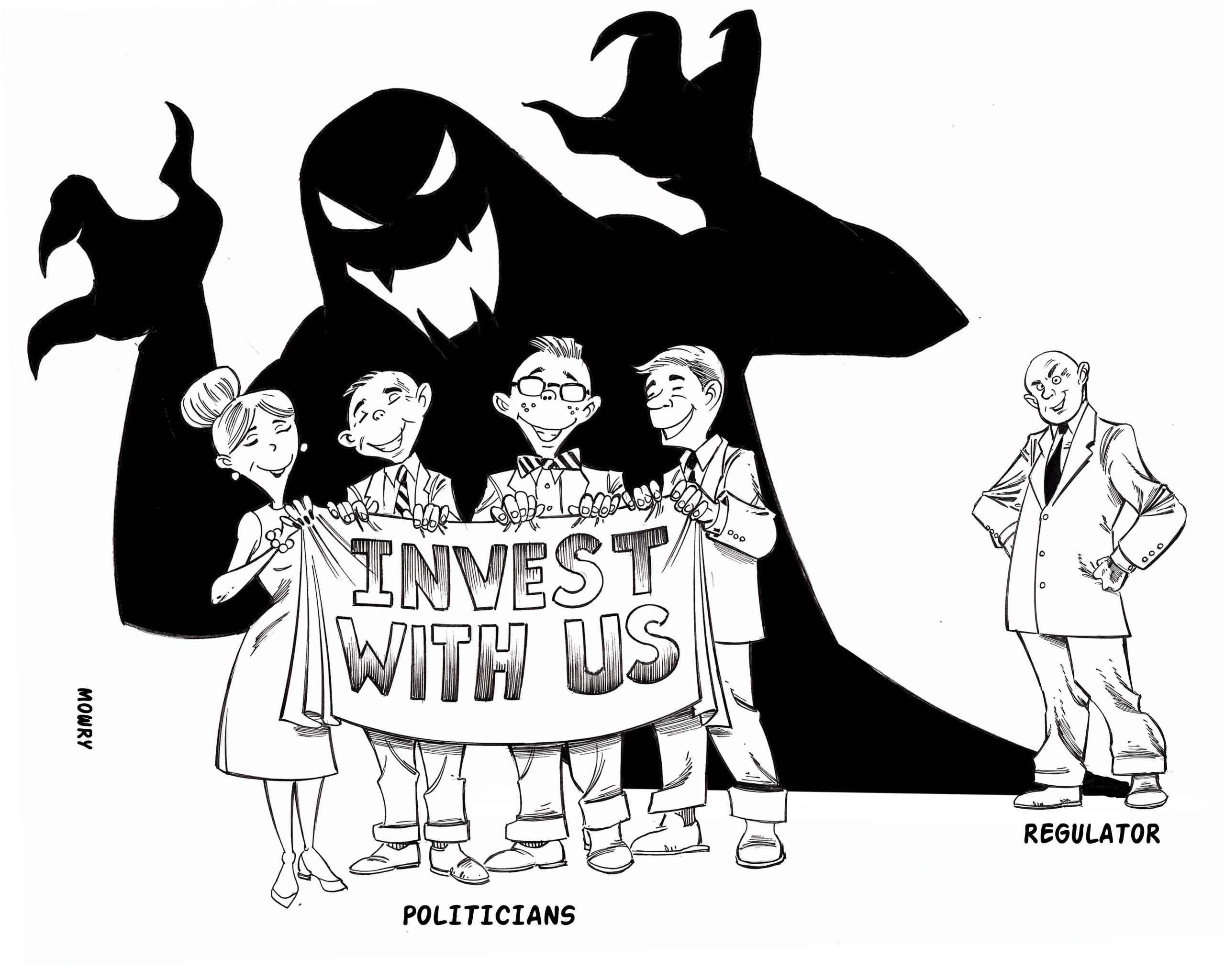

In sum, dividends consumed the discourse over the UK’s water industry and the regulator then took the unprecedented step of regulating them directly. While it doesn’t often boil over like this, some zero-sum discourse between profits and investment is very common in the infrastructure investment industry. The Cunliffe Commission was an opportunity to take it up. Did dividends sully the rivers?

Mixed Bag

The Commission might have started by asking why dividends became such a major issue in the first place. There are many regulated companies in many regulated utility industries around the world. Utilities and their regulators are always at loggerheads over prices, but a zero-sum framing of dividends is rare.