As Director of Transportation Policy for Reason Foundation, I’ve been writing this monthly column in Public Works Financing for more than 25 years. For readers who don’t know much about this think tank, you can get some perspective by perusing our website (https://reason.org). We are a nonprofit public policy organization, with a journalism division and a policy research division. Reason favors limited government, individual liberty, free markets, free trade, and the rule of law.

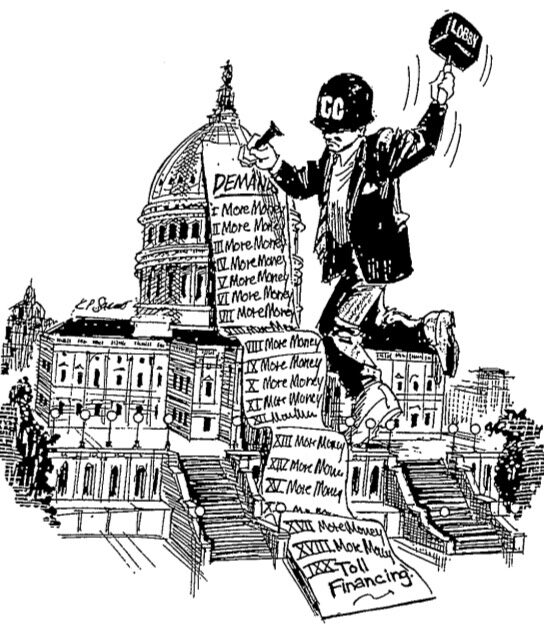

Transportation is one of many research areas we engage in. Among our transportation principles are users-pay/users-benefit, market pricing, federalism (having each level of government be responsible for its transportation infrastructure and operations), and benefits exceeding cost, wherever possible. This leads to Reason supporting road pricing, toll finance, public-private partnerships (P3s), and devolution of some functions from higher to lower levels of government.

In anticipation of reauthorization of the federal surface transportation program in FY 2026, our transportation team has developed a set of eight policy recommendations, which will likely be posted on our website by the time you read this. Not all are relevant to the focus of this newsletter, but this month I will summarize three of them, with another one discussed next month.

The first principle is to implement a more fiscally-responsible reauthorization bill. From its creation in 1956 until 2008, the Highway Trust Fund was self-supporting—meaning, the spending it authorized each year was covered by the federal highway user-tax revenues collected. But over time, Congress has undercut this basic principle. It has not increased federal gasoline or diesel taxes since 1993, but it continued spending far more than that. Secondly, it gradually converted the highway fund into a transportation fund, with grants for transit, sidewalks, bike paths, etc. So instead of viewing fuel taxes as highway user fees, taxpayers increasingly see them as just taxes—and Congress refuses to even consider raising them. If those rates were adjusted for consumer price inflation since 1993, they would bring in more than double their current amount.