On June 3rd, the Cunliffe Commission in the United Kingdom published its widely anticipated interim findings on how to fix the nation’s beleaguered water industry. Almost as if on cue, that very same day KKR announced that it would be walking away from a planned rescue investment in Thames Water, the largest and most financially distressed of all of the UK’s water companies. The firm announced its departure only days after it submitted details of its proposal to Ofwat, the water industry’s regulator. The withdrawal means that the sole remaining option for Thames Water is a potential restructuring led by the firm’s senior creditors, unless the company brings in another investor to replace KKR. The risk of nationalization is high.

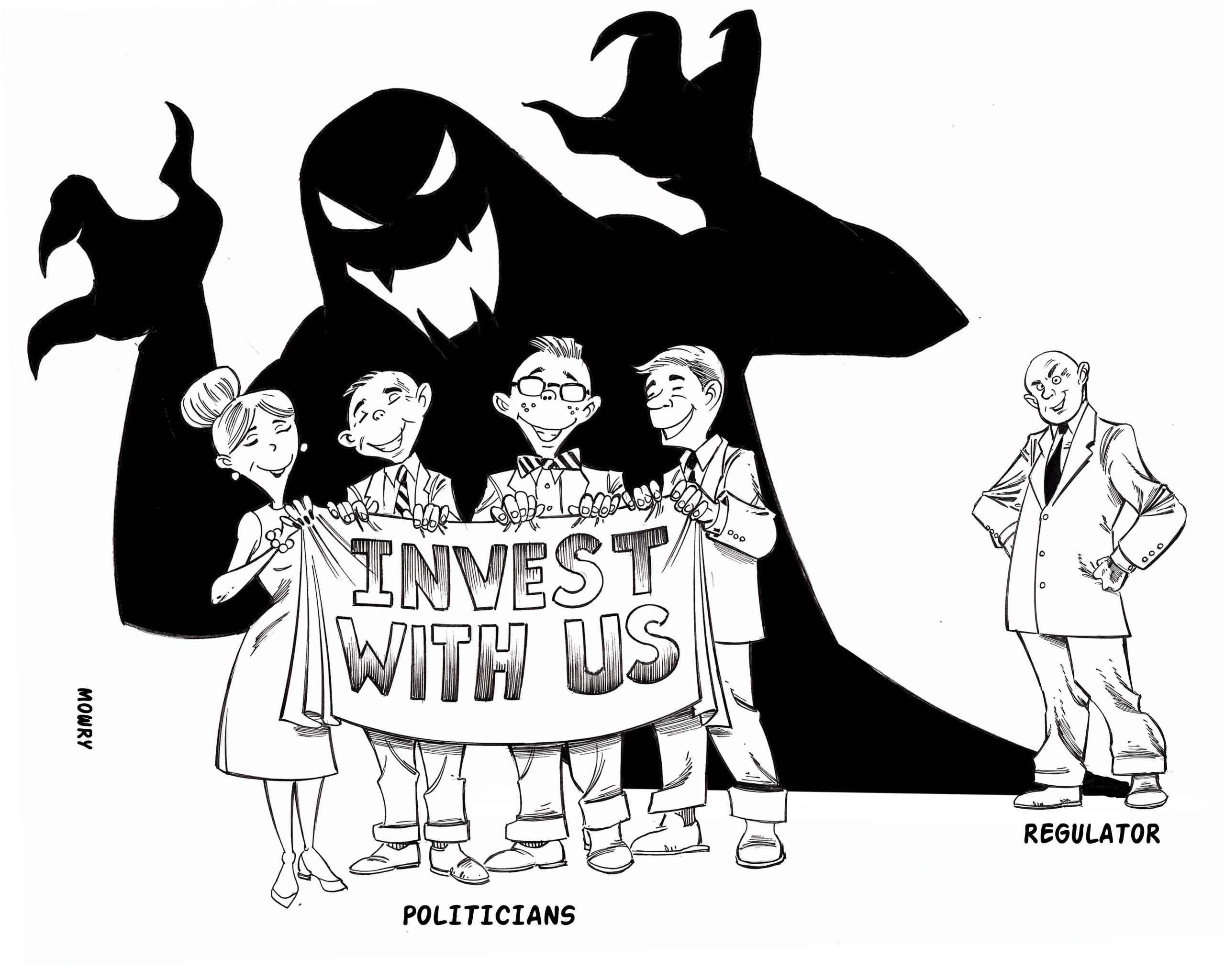

According to the Financial Times, KKR feared political risk when considering a $4 billion rescue investment in the water utility, given the time needed to turn the company around and the wide range of potential policy changes that could come from Ofwat or future governments.

It isn’t hard to see why. Just days before KKR withdrew from the deal, Ofwat fined Thames Water £123 million, the largest set of fines ever on a UK water utility, for violating rules regarding storm overflows and another rule preventing the company from making dividend payments.

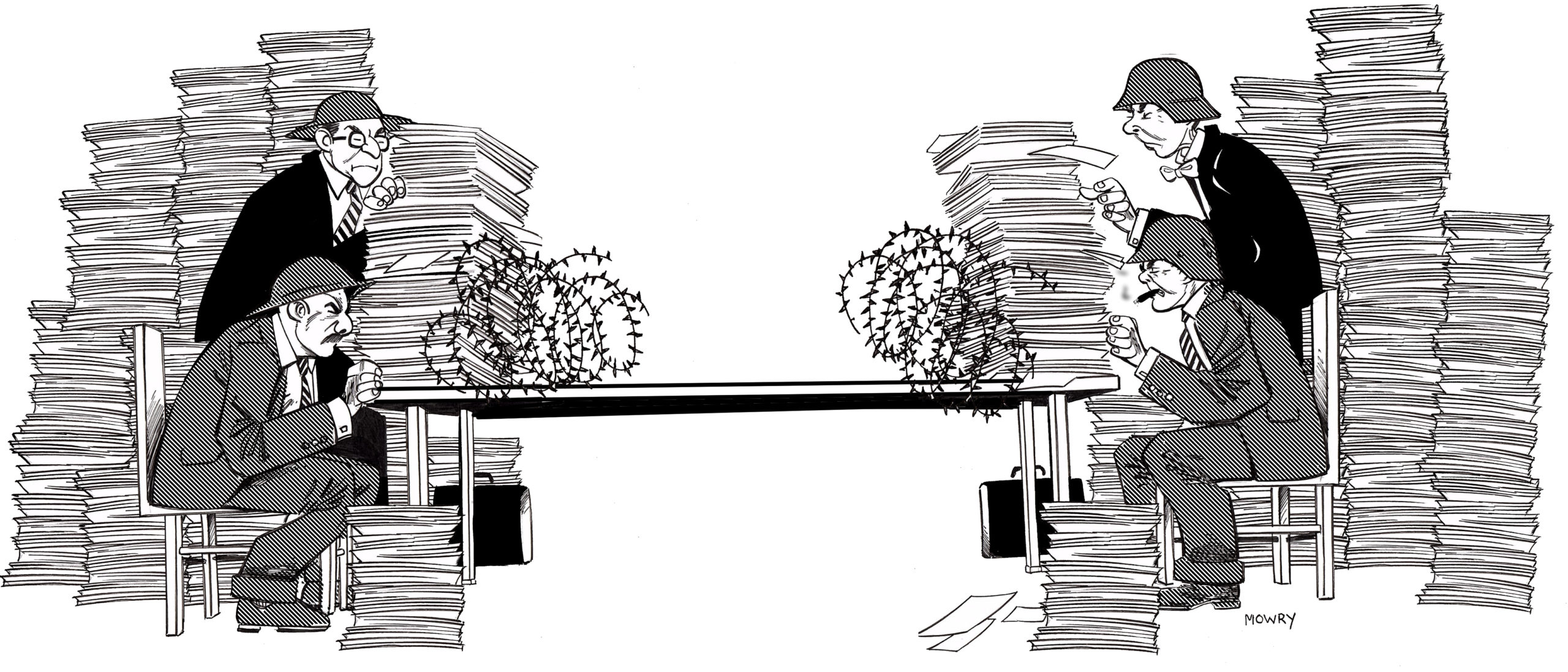

Early statements from the Cunliffe Commission last year were promising, and indicated that the commission appreciated the extraordinarily high levels of political risk in the UK water industry. Unfortunately, the interim findings published in early June are a step in the wrong direction, or rather, a step in every direction. The report both recognizes the political risk and unbelievably complex regulatory morass of the sector currently, but also proposes new powers for Ofwat and other regulators. If the commission’s final findings, which are due later this summer, remain in line with the interim report, the commission won’t save the UK water industry.