Given the advanced age of most of America’s Interstate highways, it was inevitable that one state would eventually volunteer to be the first-mover on toll-financed Interstate reconstruction. Indiana has now stepped forward.

Legislation authorizing the state DOT to use toll financing to rebuild all six of the state’s long-distance Interstates passed via a large, bipartisan majority and was signed into law in mid-June by Gov. Mike Braun. Interstate tolling also has strong support from Indiana’s business community, which shares INDOT’s concern about the decline of fuel tax revenues. Because Indiana is only 149 miles wide, lots of truckers and motorists can drive through without purchasing fuel.

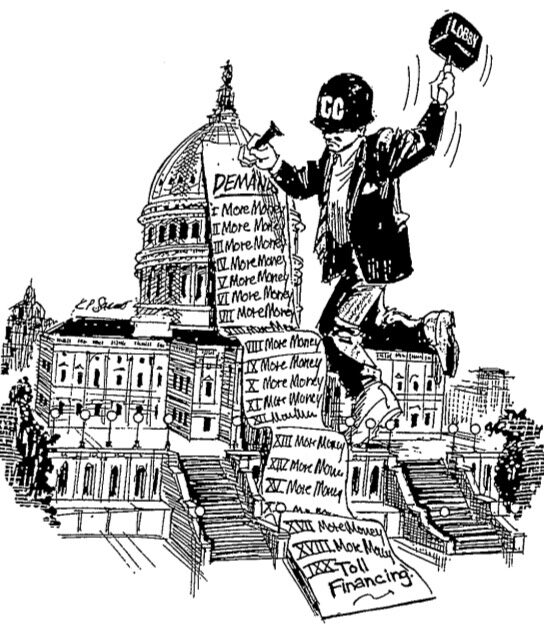

Congress has ignored repeated studies on the need to reconstruct Interstates that are well past their 50-year design life. Since Congress is clearly not prepared to act, it is up to states to take charge of rebuilding these vital state-owned corridors.

The basis for Indiana’s toll-financed Interstate reconstruction was provided by two consulting studies: a tolling feasibility study by HDR in 2017 and a major Statewide Interstate Tolling Strategic Plan by HNTB in 2018. Seven years later, the stars aligned for Indiana’s landmark legislation.

To become a model for other states to follow, it’s important for Indiana to get this right. Here are some thoughts on how to deal with several key topics.

The first is getting federal permission to implement tolls on Interstates. The HNTB study reported that INDOT had been assured (in 2018) by FHWA that it could use the “bridge exception” to implement tolls. A current provision in federal law permits tolling of currently non-tolled bridges on Interstates. Whether that provision will pass muster for tolling every overcrossing on a long-distance Interstate remains to be seen.

Indiana could begin its program by using two more-straightforward federal tolling provisions—applying for one of three open slots in the Interstate System Reconstruction and Rehabilitation Pilot Program (for one rural Interstate) and a slot in the Value Pricing program (toll all lanes to address congestion) for an urban Interstate (such as I-465 beltway around Indianapolis). Indiana’s congressional delegation could then support liberalizing ISRRPP so it would allow every state to toll all its Interstates (a measure Reason Foundation has suggested for the 2026 surface transportation reauthorization bill).

A second concern is fairness to Interstate users, motorists and truckers alike. Auto and trucking groups have long decried “double taxation” on tolled highways—meaning the requirement to pay both tolls and fuel taxes on the same highway. As part of the transition from state fuel taxes to state-authorized tolling, Indiana could offer refunds of state fuel taxes for state residents’ trips on rebuilt tolled Interstates.

INDOT’s likely first reaction would be “Oh, no! We need every dollar of that declining fuel tax revenue.” But that ignores the fact that it costs a lot more to build and maintain a lane-mile of Interstate than a lane-mile of an ordinary highway. That’s why Interstate tolls (where they exist) are generally twice as much per mile than fuel taxes. So INDOT would do better by offloading Interstate reconstruction and maintenance, so that nearly all its fuel tax revenue could be devoted to its non-tolled roadways.

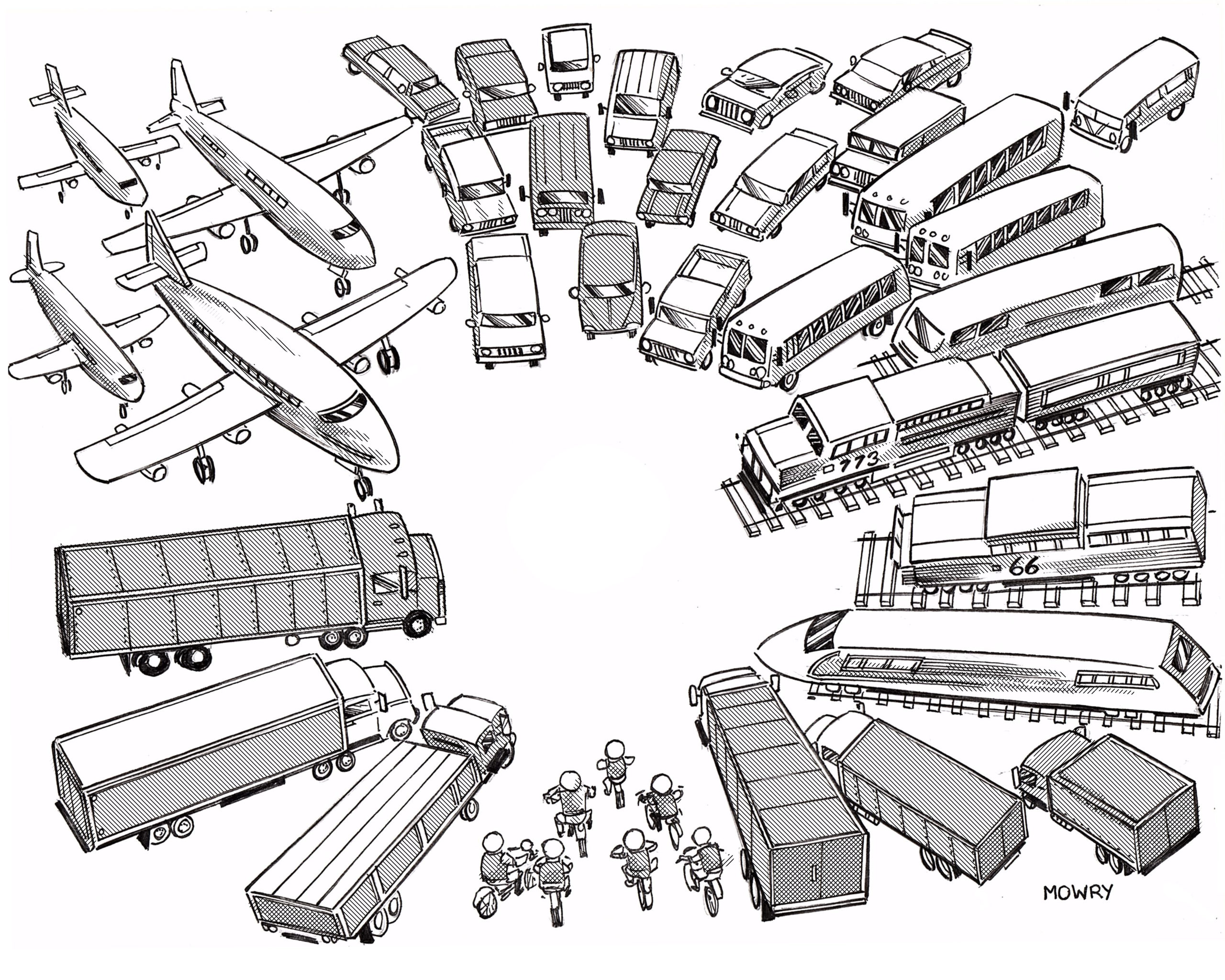

A third recommendation for INDOT and other toll supporters is to focus on the reconstruction, not the tolls. Indiana’s Interstates rank in the bottom third of states in terms of pavement condition. Their heavy truck traffic wears them out faster than if there were less truck traffic, but state and federal projections show truck traffic increasing twice as fast as personal vehicle traffic in coming decades. In addition to reconstruction, some of Indiana’s long-distance Interstates are likely candidates for adding dedicated truck lanes.

Last but hardly least, Indiana should seriously consider procuring these major reconstruction projects as long-term DBFOM P3s, financed based on the projected toll revenues. As “brownfield” concessions, these projects might attract up-front concession fees from equity investors. Using toll revenue bonds would provide an important reality check on traffic projections and the financing plan, limiting or eliminating any potential for taxpayer bailouts of a project gone wrong. Bondholders also insist on serious maintenance accounts and reserve funds, to enable such projects to survive economic downturns.

As the first mover among states on toll-financed Interstate reconstruction, Indiana is in a good position to attract serious interest from P3 infrastructure investors. As I write, the United States is in the early stages of a large array of greenfield P3 express toll lane projects, which may run up against limits of tax-exempt private activity bonds (PABs) and federal TIFIA loans. Congress should address those limitations in the 2026 reauthorization.

Another constraint may be a shortage of P3 consortia with enough equity investors, designers, and construction companies with the P3 track records needed to qualify for major P3 highway projects. If one or two other states passed similar toll-based Interstate reconstruction projects in the next year or two, such constraints are certainly possible.

Fortunately, Indiana law already grants P3 authority to both INDOT and the Indiana Finance Authority. The state also has experience dealing with a large brownfield concession via the long-term P3 lease of the Indiana Toll Road.

These factors suggest that Indiana is in a good position to succeed in its self-selected role as the first state to opt for rebuilding and modernizing its aging Interstates via toll financing. With eight states having done Interstate tolling feasibility studies in recent years, I would not be surprised to see a few of them—such as Michigan and Wisconsin—looking seriously at following Indiana’s footsteps.