Study by John Salazar and Petr Matous

It is widely recognised that institutional quality is an important determinant of the success of PPPs. Institutions including political, legal and public sector environments are crucial to attracting private investment and ensuring PPPs are legitimately governed.

This paper conducts an in-depth study of the institutions that influence PPP performance. Specifically, it examines the dynamic nature of interactions between institutional variables and PPP market performance at different levels of market maturity.

In this context, market maturity refers to the investors’ willingness to finance PPP projects in a market, considering their financing feasibility and profitability. Achieving market maturity relies on the government’s ability to implement efficient PPPs, which, in turn, depends on developing trust, legitimacy, and capacity elements. Taken together, these elements correspond to the necessary institutional capabilities for PPP market maturity.

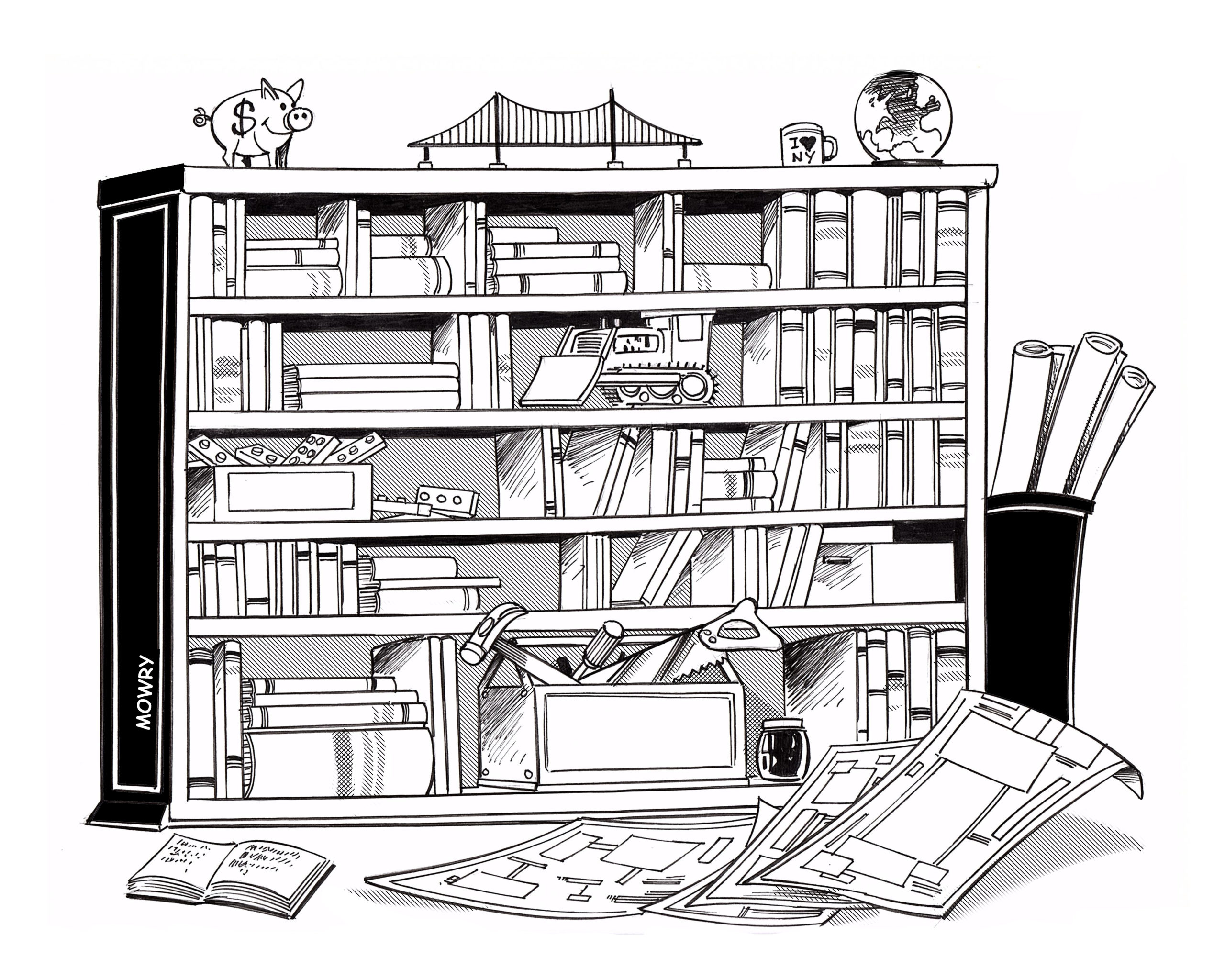

The paper provides a detailed discussion of how institutions support or hinder successful PPP development and outcomes. This discussion is framed by the nature of the dataset used for analysis. The Infrascope dataset incorporates information (relevant to 2019) from 69 markets in low and middle income countries. This framework quantifies PPP market maturity using a nested structure of five higher-level institutional factors, broken into 23 indicators and 78 detailed sub-indicators (institutional variables).