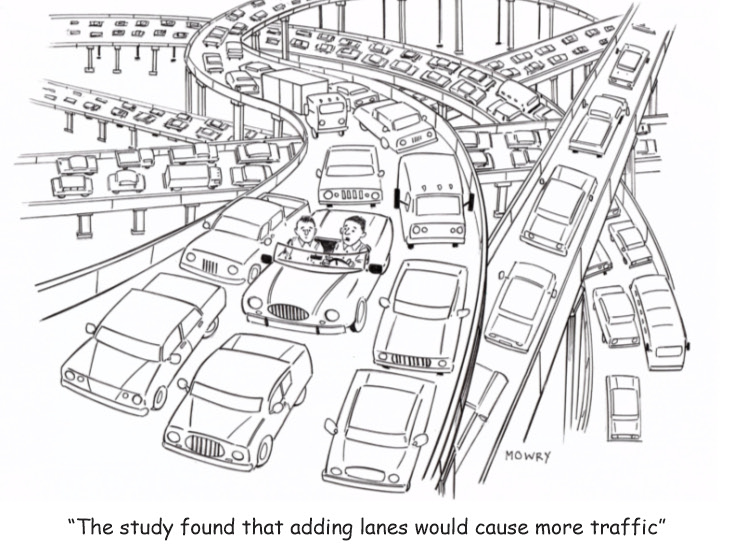

Most transportation professionals are persuaded that paying for America’s highways via per-gallon fuel taxes is not sustainable much longer. While the transition to electric vehicles has slowed somewhat, hybrids increasingly contribute to lower fuel-tax revenues, and federal new-car mpg requirements are now the largest factor in projected decreases in gas-tax revenues.

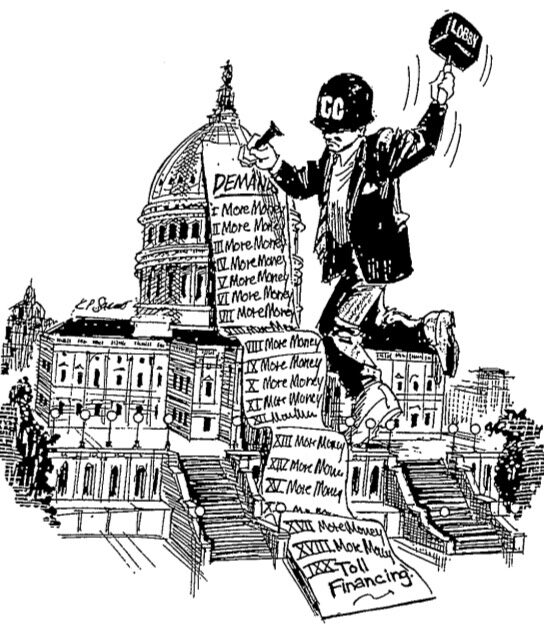

Over the past nine years, Congress has funded a growing number of state mileage-based user fee (MBUF) pilot projects, which have had generally positive receptions from the very small fraction of a state population that participated. But elected officials (state and federal) are all over the map on how to replace fuel taxes, with some calling for a new federal vehicle registration fee and others wanting EVs to pay twice as much per mile as petroleum-fueled vehicles pay today.