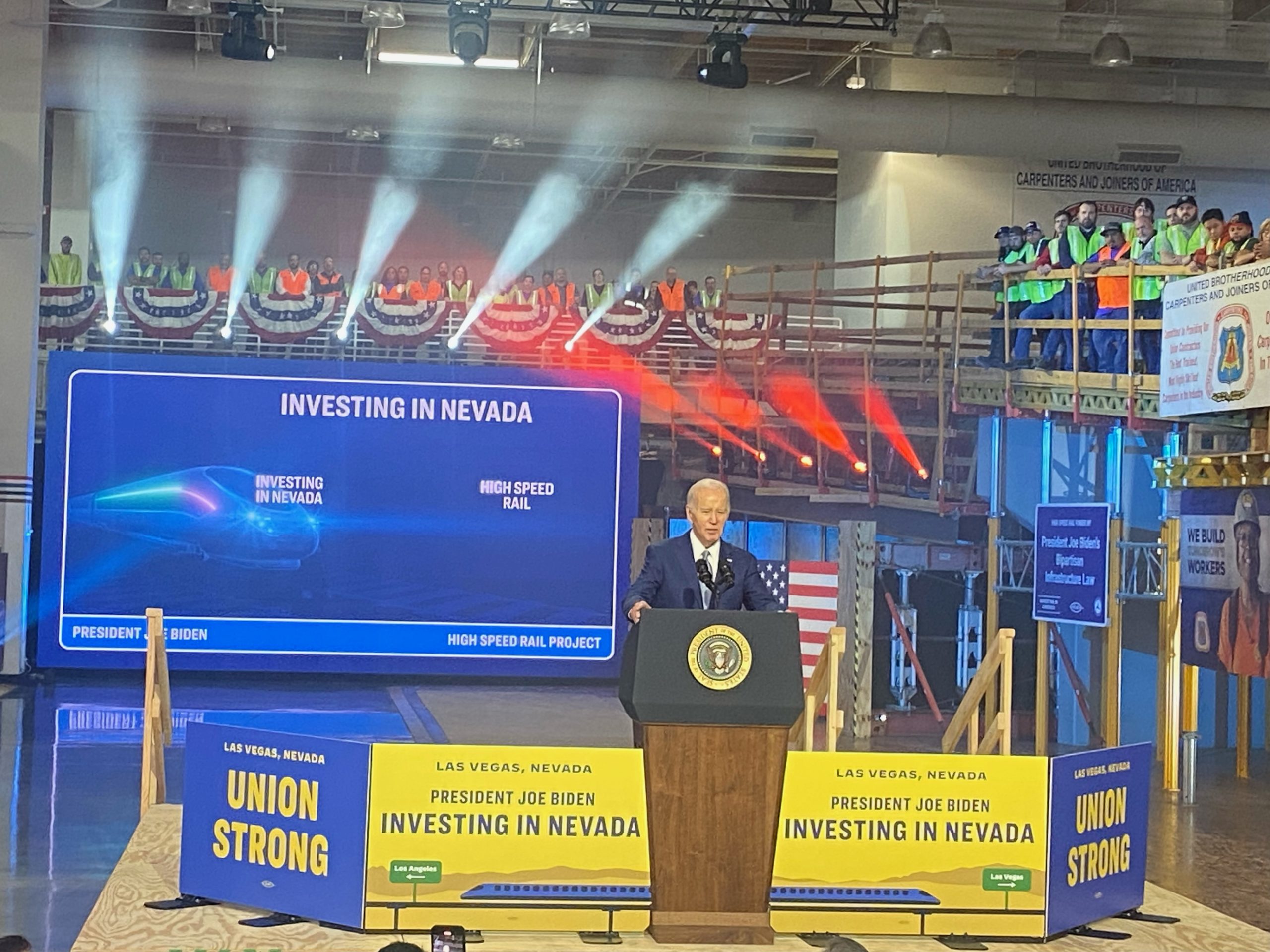

Brightline West, the company developing a 218-mile high-speed rail line between Rancho Cucamonga, California and Las Vegas, is facing a crunch financing deadline in November on a $2.5 billion Private Activity Bond (PAB) issuance from earlier this year. The project bonds included a 270-day deadline to either complete the project’s capital structure or face a mandatory redemption. The company is currently in negotiations with bondholders for a restructuring that will give the company more time to complete the project’s capital structure.

Brightline West issued the PABs in March. The financing allowed the project to take advantage of a significant portion of the $3 billion federal grant that the project received during the Biden administration, due to federal cost share requirements. The unrated, high-yield issuance was oversubscribed by investors, and carried a 9.5% term rate.

That PABs issuance included a requirement for the project to complete its capital structure within 180 days of the issuance, which was extendable to 270 days. That places the megaproject in a tough negotiating position with bondholders leading up to a November deadline.