Transportation Secretary Sean Duffy joined the inaugural meeting of the Department of Transportation Advisory Board earlier this summer at the White House. Overall, the meeting was extraordinarily promising for American transportation P3s. Again and again, Secretary Duffy mentioned the need to find ways to leverage private investment and create projects that attract private capital, and he wants to reform things quickly. He told the Board that “the mission is speed. We’ve got to do this fast.”

However, right out of the gate, the Secretary mentioned a more surprising concern: “In a number of our projects, what we see is opportunity for private capital. And often times…it’s frustrating because it’s a lot of foreign private capital. And it seems like there’s some pretty good returns that they’re making on American infrastructure. It’d be great if we were able to get American private capital into American infrastructure and see those returns go to American investors. I don’t think we’ve done a very good job of that thus far.”

Foreign investors – it seems they’re a problem in every country. American voters want American firms and funds to develop American infrastructure. The same goes for every other country, or Texans for Texas and so on. Dismissing that sentiment as narrow parochialism, however, can lead one to neglect the very real political risk that it creates. People, and the politicians they elect, simply tend to see infrastructure as a more zero-sum transaction when foreign firms are investing.

And of course, in select circumstances, there are legitimate concerns regarding foreign investment. National security concerns do overlap with some infrastructure projects. Similarly, given the rise of various forms of state-capitalism and state-owned enterprises in the infrastructure sector, there could be legitimate apprehension when those entities are investing, as opposed to private foreign firms or fund managers.

But the United States already has foreign investment policies that address either of those special cases, and they aren’t the source of Secretary Duffy’s concerns. His was the more generalized version: there is foreign capital in U.S. P3 projects and that it is making “pretty good returns.” And if any investors are making good returns in American infrastructure, it should be American investors.

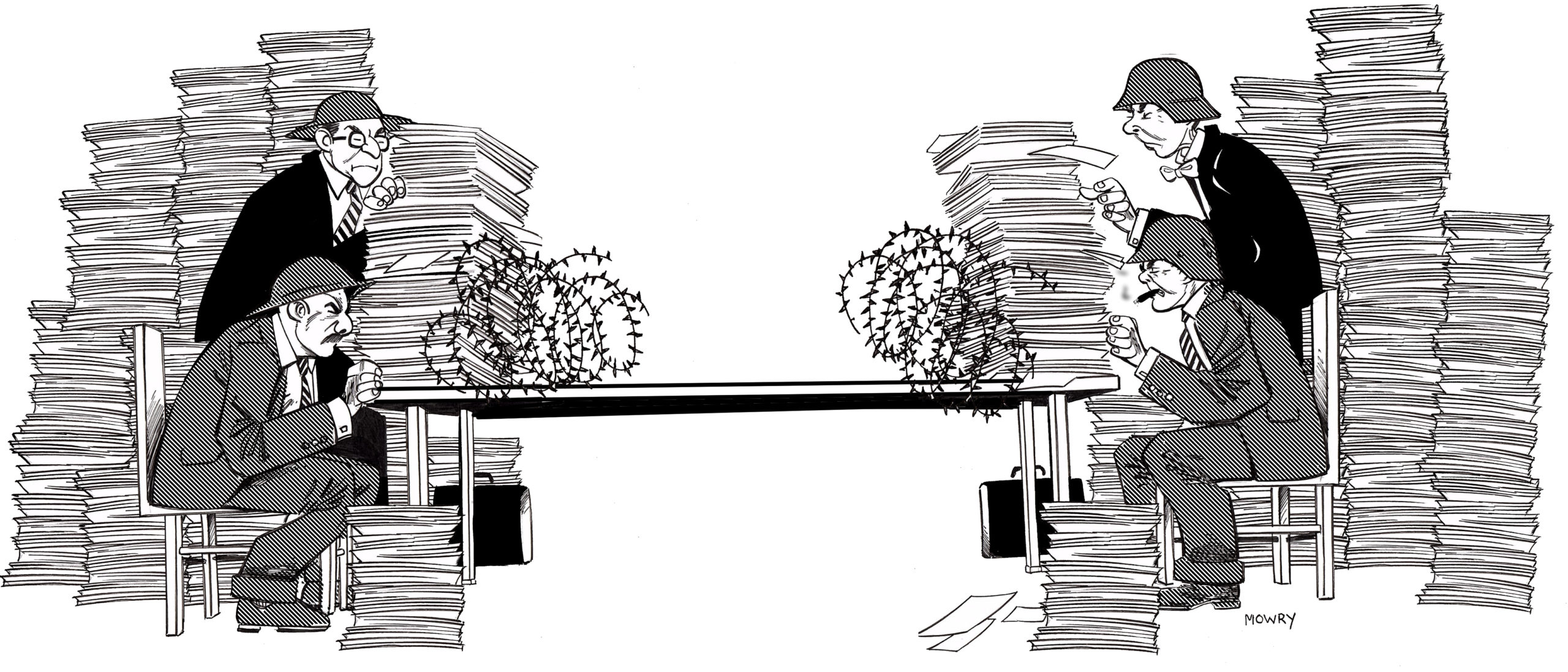

How do we solve this problem? There are some heavy-handed solutions which are technically possible, but unworkable. We could outright ban “foreign” capital or put in place some kind of a procurement preference for American investors. But these would limit competition, destroy value-for-money, and increase costs for the public. Public sponsors tend to optimize their procurement policies for taxpayers, not investors. That should probably continue.

But hope is not lost. Select improvements to the U.S. P3 industry will absolutely bring more American capital in, and some policy reforms under Secretary Duffy’s purview could help them along. Below is PWF’s three-step guide to better Americanize American infrastructure.