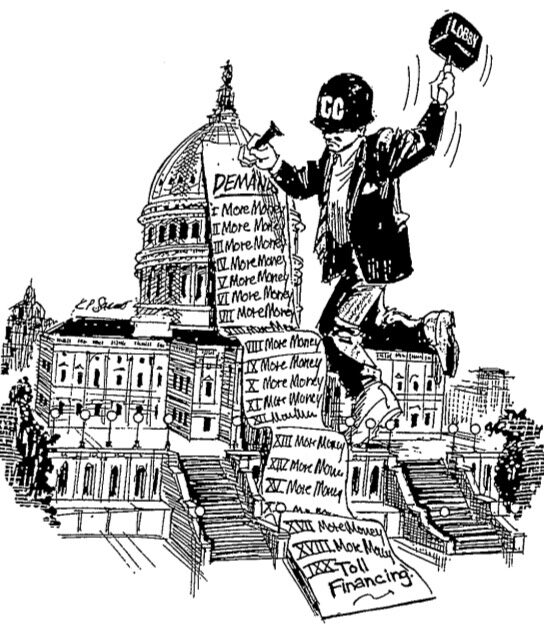

These are boom times for revenue-risk DBFOM P3 highway and bridge projects. The current pipeline includes three huge projects being offered by Georgia DOT in Atlanta, a planned $2 billion bridge across the Mississippi River planned by Louisiana DOTD, North Carolina DOT’s $3.1 billion I-77South express toll lanes project, and four express toll lane projects planned by Tennessee DOT. Possible additions to this pipeline are Illinois DOT’s first express toll lanes project on I-55 and Virginia DOT’s extension of express toll lanes on the I-495 Beltway to or across the Woodrow Wilson Bridge.

I did some back-of-the envelope estimates of the capital costs of this set of projects and came up with $31 billion. There has never been a revenue-risk P3 pipeline of this magnitude. So the obvious next question is: What kind of demand for tax-exempt PABs would this pipeline generate?