2024 is a promising year for the US P3 industry. More states, cities and other public sponsors are considering alternative procurement to deliver their projects, passing enabling legislation, or applying P3s in new sectors.

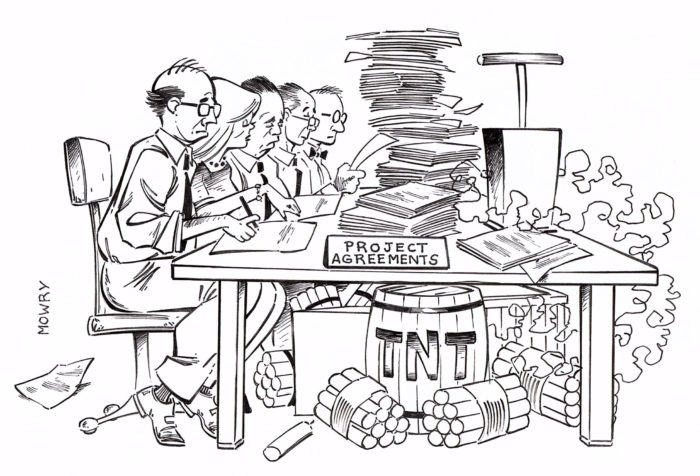

At the same time, public sponsors in the industry are facing new challenges. 2023 saw a continued trend of high-profile project cancellations. Public sponsors are also still adapting, and figuring out, delivery using predevelopment agreements (PDAs) or “progressive P3s.” Cost escalation and third-party risks remain high.

For some guidance on how public sponsors can navigate these challenges, PWF interviewed Nossaman’s Elizabeth (Liz) Cousins. Liz became the Chair of Nossaman’s Infrastructure Group at the beginning of 2024, taking over the role from Patrick Harder, who is staying on at Nossaman as a partner. She has more than 18 years of experience advising clients on P3s, progressive procurements and other alternative delivery projects in the US and Australia.

Our interview topics included ways that public sponsors can mitigate cancellation risk, procuring PDAs while maintaining competitive pricing, navigating federal discretionary funding during predevelopment, and dealing with construction cost inflation.

Structuring Progressive P3s

PWF: Predevelopment Agreements or “Progressive P3s” continued to rise in popularity in 2023. They were intended to help resolve third-party risks like environmental permitting or utility relocations before finalizing the P3 concession, but they also create new risks regarding project cancellation. Do you have any recommendations for public sponsors regarding compensation or phasing for PDAs to mitigate cancellation risk?

LC: Early involvement of a developer has capacity to de-risk a project by enabling the developer to gain greater understanding of the project through further investigation and design This has the benefit of reducing contingencies in Proposal pricing, limiting the need for developers to provide potentially “heroic” risk and cost assumptions, and providing greater certainty for public agencies.

In terms of compensating the private sector, it is important to strike the right balance between incentivizing the private party (i.e. through a competitively bid fixed or guaranteed maximum price for any pre-development work), while also appropriately compensating the private sector for work product prepared.

We must also remember that collaborative procurements, by their nature, are intended to allow the public sector to better evaluate complex projects. And that although “cancellation” can be perceived as failure, this is part and parcel of the delivery model that enables public owners to make a fully informed decision, before proceeding with a long-term contracting arrangement.

Preventing Project Cancellations

PWF: 2023 saw some very high profile project cancellations, some of which occurred after the selection of a preferred bidder. What are your top recommendations for public sponsors to reduce cancellation risk for procurements in 2024?

LC: Some critical factors to minimize cancellation risk include:

– Carefully evaluating the project at the outset to ensure it is appropriate for early contractor involvement or P3 delivery;

– Early identification of funding strategy and sources;

– Preparing the agency and key decision makers to develop an appropriate internal culture for successful delivery of P3 projects. In particular to understand the process and key decision making milestones necessary for project approval. This is particularly important since many agencies have deeply entrenched views around fixed-price / traditional contracting that can prove very difficult to adjust; and

– Where possible, getting early approval of key commercial terms and a pricing upset limit, which if met, results in approval of the implementation phase or P3 project – without the need for significant additional approvals.

Getting Competitive Pricing with a PDA

PWF: Another big challenge for public sponsors using PDAs is competition, since the preferred bidder is selected before predevelopment is completed. What is your advice for public sponsors to maintain competitive pricing while using a PDA?

LC: Pricing creates challenges even in fixed price contracts, because contract price isn’t the only indicator of value. All too often, the lowest bid does not take into account risks retained by owners, whole of life issues, asset performance, or aspects of a proposal that exceed minimum performance specifications. Some strategies we recommend to maintain competitive pricing include:

– Requiring profit margins and labor rates for each phase to be included in the original proposal;

– Conducting an independent cost assessment to assess pricing validity;

– Where appropriate, considering having a competitive target cost development with multiple bidders during the early contracting phase;

– Requiring a subcontractor procurement plan; and

– Ensuring all reviews are conducted on an open book basis, with regular updates of the financial model through the iterative design process so the owner and developer have the opportunity to design to budget.

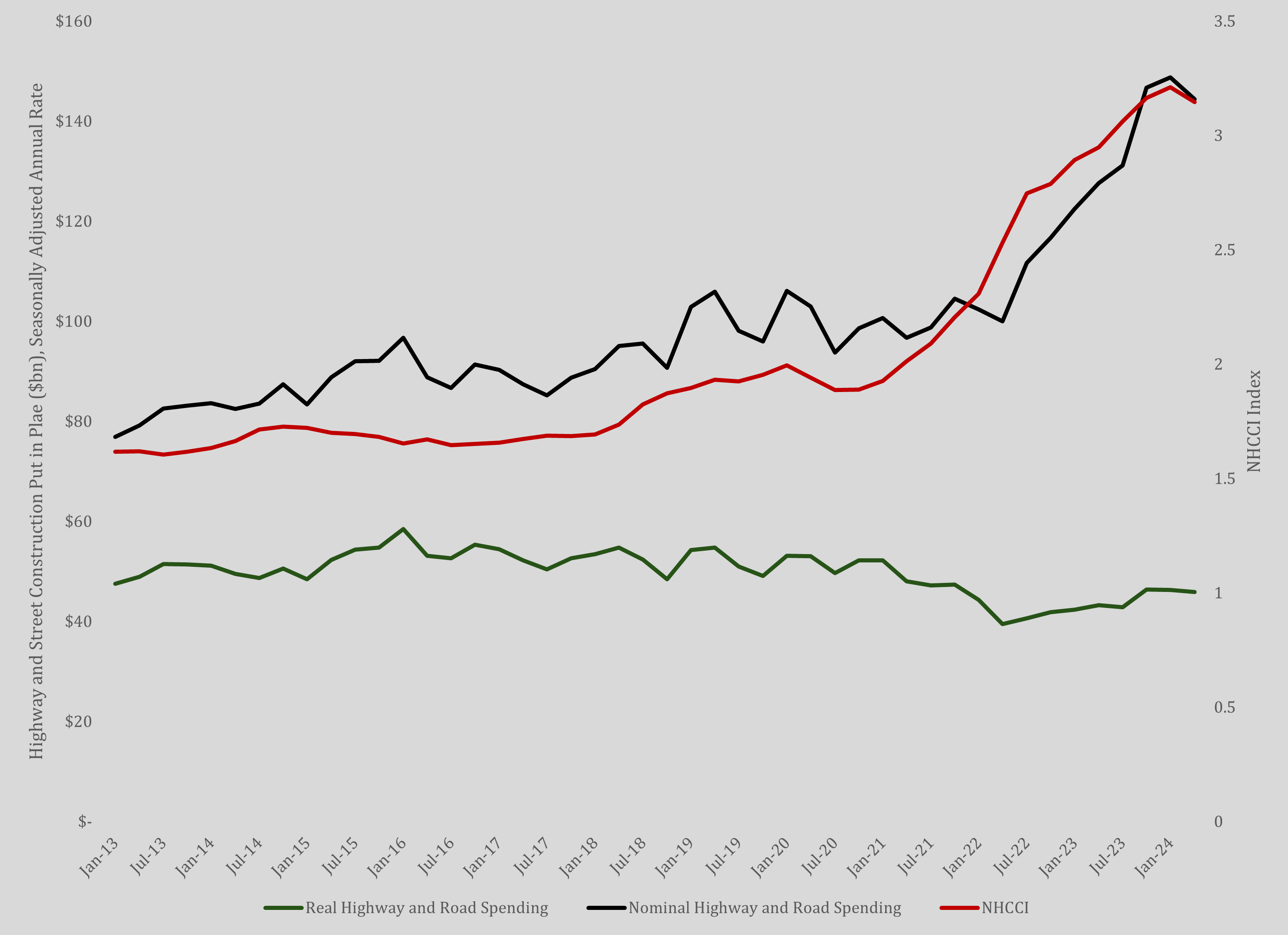

Dealing with Construction Cost Inflation

PWF: Inflation in the construction sector is still a considerable source of uncertainty for progressive P3s. Do you have any recommendations or best practices for public sponsors in incorporating potential cost inflation into predevelopment agreements?

LC: Recent deals we have been involved in have implemented a range of innovative strategies including linking pricing of materials to specific fixed commodity indices and allowing pricing of speculative components to take place very close to the final owner decision in order to minimize contingencies.

Some owners have also been willing to take the risk of escalation above a standard escalation index in order to reduce the risk of significant contingency being included in proposal pricing.

PDAs and Federal Grant Uncertainty

PWF: A final source of uncertainty for P3s using PDAs comes from discretionary grant funding under the IIJA. Many public sponsors are entering into PDAs while still planning to apply for IIJA grants, and in some cases are planning to apply for grants jointly with their predevelopment partners. Do you have any recommendations for public sponsors regarding how to incorporate grant applications into PDAs?

(Here, Liz noted that for this topic, she solicited input from Shant Boyajian, her colleague and fellow partner at Nossman, as an expert of federal infrastructure policy.)

LC: There are two important considerations that public sponsors should bear in mind when considering federal grant funding for the implementation of a project being delivered under a pre-development method.

First, project sponsors must recognize that if the funding gap for full implementation of the project is great enough, it will be a significant challenge for the project sponsor to generate sufficient market interest. This may result in a limited pool of interested competitors, even at the pre-development stage, which will put the public agency in a disadvantageous negotiating position with respect to the PDA, and ultimately the resulting commercial deal.

Second, project sponsors should weigh the value of later private sector innovation in the grant writing process compared with early engagement with a consultant with specific grant-writing experience who can potentially position a public agency to solidify the funding sources needed to garner greater competition.

Future of PDAs in the US P3 Market

PWF: Are there any other major trends PDAs or P3s that you see going into 2024?

LC: I believe there is always going to be a place for fixed-price P3 contracting. Competitively tendered, fixed-price deals remain very attractive to owners – despite risks often being misaligned and contractors seeking to recover lost margin on the backend through disputes and claims.

For complex infrastructure projects where risks are not well understood at the outset, it seems natural that early contracting involvement models will and should be considered. Alternative delivery is in many ways still newer to the US than other jurisdictions.

Having practiced internationally, I have also observed that these trends tend to be cyclical. Where contractor work flow is low and contractors are willing to more aggressively price work to win projects – some owners remain willing to take advantage of that. In a more competitive market where contractors have the luxury of being more selective, owners need to use innovative tools to attract participants to the market – in particular for major infrastructure projects where there is already a more limited field of potential contractors in the market.